- Overview

- Your Challenges

- Services & Products

- About

- Blog

- Contact

Make Your Numbers and Quit Whining

07.18.17| Demonstrate Your Value

“Investment is an exchange of money today for money tomorrow.”

–The Economist

A sales executive we’ll call Lynn was rightly concerned about falling well short of target for the year. Her mid-sized firm’s marketplace had shifted quickly; piranha competitors furiously fought for the available opportunities. Sales and marketing approaches that used to work beautifully lost their magic.

The sales miss would mean that net income would fall short by at least $1 million—and probably twice that. Lynn and her team had tried everything they could think of, so she reached outside for help.

An innovative approach, that we both believed would address the shortfall, required a minor investment. Landing even one new account would pay back the investment in less than a month, with the benefits climbing from there.

Then we ran into an iron constraint: Her cost budget allowed $11,000 for sales training for the year. That wasn’t enough for sales training, let alone anything else we planned. Her request for approval of the modestly bigger investment was rebuffed.

“You know the culture of this company: Make your numbers! You are accountable to make your sales numbers and don’t overspend your budget,” her boss told her.

Maybe that was a good decision, maybe not. I ran into that response myself during my corporate life. I see it often in my consulting, too, and want to share the way I’ve come to think about such decisions.

Honoring Both Budgets

Honoring your cost budget is a good thing. It’s also a good thing to honor your revenue budget. As with so many decisions, it’s not a matter of choosing between a good objective and a bad one. That would be easy.

It’s when you have to choose between two good objectives (or two bad ones) that you most need a decision framework.

As is typical, at Lynn’s company the cost budgets and sales budgets were done months earlier. The circumstances then changed. If the company’s decision process doesn’t allow for changes, the right tradeoffs can’t be made. Sticking to a cost budget when doing so pretty much guarantees a sales miss is often not a consciously made decision. It’s just following a defacto decision rule (“Make your numbers and quite whining”).

One solution, of course, is for Lynn and her boss to bring the decision about the tradeoff to a higher level. She would have to demonstrate that the opportunity cost of NOT making the investment is greater than the risk of proceeding with it. But at the time, I struggled with how she could show that.

Visualizing Risk and Return

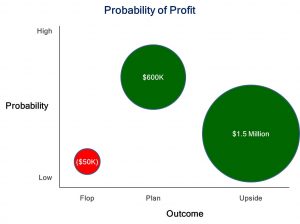

Recently I developed a visual decision tool and created the illustration below of how Lynn viewed a range of outcomes for her company’s decision.

If her marketing and sales initiative went as expected, Lynn envisioned a $600,000 gain in margin. If things went great, the result would be $1.5 million more in margin.

On the other hand, if the initiative flopped, she estimated the consequence at a $50,000 loss from margin impact combined with the cost of the program.

The senior management of Lynn’s firm wouldn’t view a loss that size as anything close to ruinous. So this is an asymmetrically positive investment profile—the size and probability of the positive outcomes greatly outweighs the size and probability of the loss.

Sure, sales execs can be optimistic, so Lynn could construct and evaluate gloomier scenarios as well.

I’ve tested this visual approach in a couple of my own business investment decisions and found that it helped me clarify probabilities and outcomes and feel good about the decisions. Try it out and let me know what you think.

The Dollars That Should Be Coming In the Door

Prudence in how many dollars we send out the door is important, which is why we do cost and investment budgets. It’s common, though, that companies don’t realize how many more dollars should be and could be coming in the door.

If you’re concerned about not generating enough sales and margin to achieve your profit goals, let’s get on the phone so we can plan to create at least $1 million of value together within 12 to 18 months. You can schedule an appointment here.