- Overview

- Your Challenges

- Services & Products

- About

- Blog

- Contact

How the Right Pricing Approach Can Free Sales to Sell

04.18.17| Get Paid for Value

“We need to free up more of your time for actual customer contact.”

An account exec told me this was a theme at a major company’s kickoff meeting. “They had an outside firm study where our sales force spends time. Apparently as a group we spend less than 25% touching the customer or directly benefiting the customer.”

That sounded familiar. I’ve heard similar statistics at various companies. Administrative activity is often the top villain, but there are others.

When I hear that a firm needs to increase the time their salespeople spend selling and the time their sales managers spend adding value for salespeople and customers, I encourage them to look at pricing processes.

When price exceptions are allowed, a lot of time gets wasted debating the right prices and getting the necessary approvals.

This use of time makes sense only on sales opportunities where there’s enough at stake. For businesses with many transactions, this approach only makes sense on a fraction of the sales opportunities.

The resource efficiency of pricing processes is one of six yardsticks I recommend using to evaluate your company’s pricing effectiveness.

Six Yardsticks for Pricing Effectiveness

Business Outcomes

As the highest priority, Business Outcomes get three yardsticks:

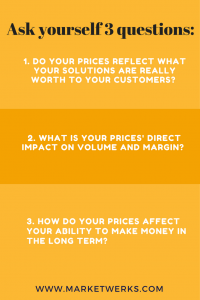

1. Worth. Do your prices reflect what your solutions are really worth to your customers?

To some customers, your prices on certain products or services are probably lower than they would be willing to pay—if you didn’t give them the opportunity to pay less. But fixing that isn’t easy. You have to systematically incorporate value as an input to your pricing, along with the prices of customers’ alternative solutions, expected volume, and costs plus target margins. How might you approach that? I outline the steps here.

2. Short Term Impact on Profits. What is your prices’ direct impact on volume and margin? This allows you to determine your current profitability, both in total and by geography, channel, and product.

Far too many salespeople assume that a price decrease will bring in more volume and raise profits. More often, it’s the reverse. You can model how much more volume you’d need to make a price decrease worthwhile, and vice versa, with this Microsoft Excel tool.

3. Long Term Impact on Profits. How do your prices affect your ability to make money in the long term? Especially if your company is a significant player in your industry, long-term profitability is deeply affected by how your company’s pricing behavior is perceived – and reacted to – by:

- Competitors

- Channel customers and end users

- Your sales force

Microeconomic theory tells you to cut your prices to get incremental volume as long as the price is high enough to exceed your variable costs and thus provide a positive contribution toward amortizing your semi-fixed and fixed costs. Called “marginal pricing,” this approach can indeed bring in incremental profit and raise total profit in the current period, all other things being equal.

The caveat is that all other things tend not to stay equal, and this creates problems in the future. Using marginal pricing often creates blowback.

Unless any price concessions are invisible to your competitors (i.e. they cannot even infer that you’ve lowered your price), or your company isn’t a significant enough player in your industry, competitors likely will react to your moves and adjust their pricing down to negate the benefit you expected.

A low price that you offer, or accept, conditions the customer to come back for another price concession in the future. And unless any customer-specific concessions remain invisible to other customers who didn’t get one, count on the others being unhappy.

Finally, how firmly and confidently will your sales people defend your company’s prices in subsequent interactions with customers? They’ll also have lower pricing expectations for future pricing decisions in which they have decision authority or input.

To read more about the effects on long-term profits of making price concessions now, click here.

Inputs & Outputs

Your prices are inputs for some of your business processes and outputs for others. They are also inputs for your channel partners’ and customers’ business processes. This means that we need 3 more criteria for pricing:

4. Speed and responsiveness. Your market is changing all the time. To be paid what you’re worth in a competitive market, your pricing adjustments need to be made with speed and responsiveness to changing conditions. That’s easier when you make fewer adjustments.

5. Quality aspects. Your price outcomes should exhibit consistent accuracy and conformance with your plan, so that prices actually charged reflect intended prices.

If you think of prices as the outputs of a process ‒ much the way you’d think of products as the output of a manufacturing process ‒ the problem in many businesses is there are so many transactions that it’s hard to evaluate whether the pricing process is producing appropriate and consistent outputs. Graphical reports can help. Click here to learn more.

6. Resource efficiency of pricing processes. As noted at the beginning of this article, the processes for setting and administering prices are often intertwined with related business processes. That’s why it’s important to ask, “Do we really want a lot of customer-specific pricing? By the current methods?”

These yardsticks can point out ways to improve your company’s processes for making and implementing pricing decisions. Such improvements are a proven way to grow sales and margins at the same time.

Want to estimate how much these improvements could be worth for your company? Access my free article, The 1% Change That Can Bring In Millions, to find out the bottom line impact.

Bob Sherlock